| |

Sept. 11, 2023 - Judge Reinhart released his findings about Form 1.977

Considering the Judge's familiarity with Craig's repeated obstructions, it's surprising that he didn't hold him accountable for the same behavior involving this debtor Form.

Back in 2019 the Judge had this to say about Craig's actions.

"His conduct has wasted substantial amounts of the Court’s time and the plaintiffs’ time and resources, which could have been saved. His behavior has unnecessarily protracted this litigation."

But this time the Judge wrote...

"W&K has not

shown by clear and convincing evidence that the information provided by Dr. Wright

is currently inaccurate. Nor has W&K shown that required information was omitted

from the Form"

How can information tied to Craig's fake Trust even be assumed accurate when factual findings show it was built upon lies and forgery?

The first example of inaccurate information has to do with Craig's claim of not owning any shares in companies. His attorneys argue that the shares are held within a trust called the Tulip Trust. Judge Reinhart previously found that this alleged trust didn't even exist. The Judge said "I find that Dr. Wright’s testimony that this trust exists was intentionally false. And although I am only required to make this finding by a preponderance of the evidence, if required to do so, I would find clear and convincing evidence to support it." "Dr. Wright’s false testimony about the Tulip Trust was part of a sustained and concerted effort to impede discovery in this case." "He also gave inconsistent sworn testimony about what is in the alleged trust."

The Judge clearly determined that the Tulip Trust was lacking any credibility. yet sruprisingly he recently allowed Craig to use it as credible evidence in support of his debtor form compliance.

I don't understand the inconsistent rulings.

There is a well-established legal principle that evidence obtained through fraud, forgery, or deception is generally considered inadmissible in court. The principle is often referred to as the "exclusionary rule" or the "fruit of the poisonous tree doctrine." This rule aims to deter illegal and unethical conduct by excluding evidence that is tainted by such misconduct.

It is obvious that Craig's latest Trust is not separate or distinct from the prior ones. Each revision of it is part of the same overarching scheme to deceive and mislead.

Craig has changed his Tulip Trust story multiple times, until ultimately molding it into a self-serving instrument for personal gain. Originally, he told the court that the Bitcoin was held in a blind trust in which he was NOT a beneficiary or a trustee. It turned out that the blind trust wasn't blind at all because he was in fact listed as a trustee. Then Craig lied about not being a beneficiary of the Trust. Then he lied about Dave never being a trustee of it. Here is Craig's declaration where he swears that Dave was a trustee.

https://www.courtlistener.com/docket/6309656/222/kleiman-v-wright/ pg. 2

In 2019, Judge Reinhart completely rejected Craig's testimony about the Tulip Trust and ruled in favor of sanctions against him because the information he provided was totally INCONSISTENT and UNBELIEVABLE.

In addition, Craig has since made self admissions about the Trust being FAKE. The first time was in a online forum. My attorneys presented the evidence to Judge Bloom. The second time was when Craig was under oath in Norway. He admitted to drafting the first fraudulent Trust while drunk.

If the court ends up allowing the Tulip Trust to be used as accurate information, they will essentially be rewarding Craig for fraud and deception. It will be a miscarriage of justice and sets a dangerous precedent for future cases.

As for clear omissions on the form, Craig's attorneys conceded to his failure of disclosing alimony payments. He had two opportunities to explain why he left this question blank, but Craig didn't bother to answer either time. Testimony from his ex-wife shows that he was in fact paying her alimony every month.

Craig was required to list all financial accounts or investments including stocks, mutual funds,

savings bonds, or annuities, That

directive applies to all “accounts” and “investments,” including cryptocurrency.

Judge Reinhart:

If Dr. Wright has possession, custody, and control

over bit coin, small b, such that he could buy, sell, and trade

them, would you agree that has to be reported on this form?

Craig's attorney:

it is not an

account, it is something you possess. I agree that you posses

it.

Judge Reinhart:

It's not an investment?

Craig's attorney:

No, Judge, I don't believe it is an investment either.

How can Craig's attorney argue that bitcoin holdings are not an investment when it is identified as exactly that in the Trulip Trust?

The Trust shows that "Wright International Investments" is the company holding bitcoin.

If Craig didn't consider Bitcoin an investment, he wouldn't attach it to an entity labeled INVESTMENTS'

"Wright International Investments"

Then Craig's attorney concedes that if Craig bought the bitcoin it would likely need to be listed on the Form.

Attorney statement 1:

"Judge, and he

didn't buy it, so it is not an investment"

Attorney statement 2:

"if you buy it, it might be a

different answer, but it is like you mined a diamond.".

Craig has already admitted to BUYING bitcoin multiple times. He did this at trial as well as in a sworn declration. so according to Craig's attorney he should have at least listed his purchased bitcoin.

https://www.courtlistener.com/docket/6309656/217/kleiman-v-wright/ pg. 3

When it came to Craig's annual salary he declared it was 159,000 pounds. But then on a seperate sheet he said the 159,000 amount was actually a payment received from the sale of IP. Obviously they can't both be correct. Craig's attorneys also argued that technically he was not employed even though the form clearly has Nchain listed as his employer. In addition, Craig previously testified that he was in fact employed and earning a salary.

Dr. Wright testimony:

"I've got a 162.5 British pounds salary per annum, which is not the biggest in the company."

https://www.courtlistener.com/docket/6309656/845/kleiman-v-wright/

pg. 69

When you compare the first Form to his revised one you will also notice signs of perjury. On Form 1 Craig claimed that I owed him $10 million dollars.

He then signed a sworn declaration stating that under penalty of perjury the answers provided were true and correct. Shortly after this he submits a revised Form and changes the answer to W&K owing him $56 million. And even that perjurious answer was based on a Australian judgment that he obtained by fraud.

Another area of perjury is found on the first Form where he wrote "All other assets were formally transferred, including rights and ongoing payments as of October 2015. This declaration conflicts with a sworn witness statement he provided in 2021 where he said on Feb.8, 2020 he had received regular monthly payments in digital assets.

How many times will he get a free pass for changing sworn statements?

Unless Craig is penalized for the endless perjury and obstruction, he has no reason to stop. As evidenced by his public statements, part of his strategy is to drain people's time and resources:

"The only thing that matters is crushing the other side" "I would spend 4 million to make an enemy pay 1."

“A US Court cannot force diddly”.

https://www.bitcoindefense.org pg. 33

W&K Software

If the following court admission is not clear evidence of perjury or unlawful withholding of property, I'm not sure what is.

Nov, 15, 2021 - Craig Wright Trial Testimony:

"W&K had the rights and still has the rights to go out there and use that software to build an exchange. They could build something like Coin Base or Kraken. They could have a cryptocurrency exchange.

Coin Base which my software was better than even the unimproved stuff is now worth about a hundred billion US dollars."

https://www.courtlistener.com/docket/6309656/845/kleiman-v-wright/

Pg. 36

"The

simple answer here is all of the intellectual property that

Dave improved remains with W&K. All of the things he got

external parties to work on, not himself, remains with W&K. It

was never taken from it. It's still there. It can still be

taken and exploited by Ira if he wants."

https://www.courtlistener.com/docket/6309656/844/kleiman-v-wright/

Pg. 85

"If he wants, every single bit of that software is there right now. He could take it. He could try and build something."

https://www.courtlistener.com/docket/6309656/844/kleiman-v-wright/

pg. 79

"W&K owned every single right, and it still does today.

He can take and exploit the software TODAY."

https://www.courtlistener.com/docket/6309656/845/kleiman-v-wright/

pg. 78

*Not only did Craig lie to me for years about the software, he then lied to the Judge and Jury. If there was any truth to his testimony, the software would have been returned by now. The transcript below shows that he has been promising its return since 2014.

Aug. 11, 2014 - ATO Interviews Craig

Wright: I wanted to make sure that everything was totally legal and all the rest. Dave

has other, he’s got an estate who Andrew has been dealing with and I wanted

to make sure I didn’t rip off his estate and just go, “Ha ha, it’s my software". I

wanted to make sure everything was done legally and above-board so that Dave's heirs get this software which was being more painfui than it should be.

O’Mahoney: What was the value of that software?

Sommers: Are you asking what's the

Wright: The two tots, I think, were, it totals 56 million.

O’Mahoney: So how did it come to be that - are all the assets of the trust, they were originally sourced from you?

Wright: And Dave.

O’Mahoney: And David.

Wright: Yes.

https://www.courtlistener.com/docket/6309656/550/18/kleiman-v-wright/

pg. 41, line 18

**Nothing ever returned to "his estate".

-----------------------------------------------------

More details about where Craig failed to comply with Form 1.977

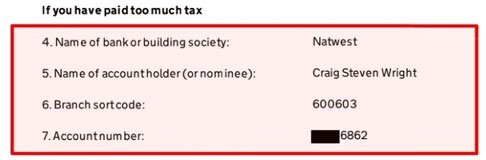

1. Inconsistent answers about bank accounts.

At first, Craig claimed not to have any bank accounts in his name.

Then he submitted a revised form and changed his answer to "I also am a titled co-account holder at NatWest."

2021-2022 tax filings reveal the bank account is listed under his name.

2. Craig completely omitted answering the question about Alimony payments. His his ex-wife, Lynn testified in 2020 that he pays her 5 to 6 thousand a month. At the evidentiary hearing Craig's attorney even conceded that this was an omission.

3. How can living expenses be more than double his employment earnings if they are his only source of income? His attorneys argue that perhaps someone gifted him the extra money.

4. Requirement to list all financial accounts, which would include those used for buying, selling, and holding Bitcoin. None were reported.

On the bottom of the form, Craig states:

"All other assets were formally transferred, including rights and ongoing payments as of October 2015."

This doesn't appear true because Craig provided a witness statement in 2021 where he mentioned receiving ongoing monthly payments in digital assets as late as Feb. 2020. <see below>

Here is Craig's Witness Statement - April 29, 2021

"At approximately 12.30pm on Saturday 8 February 2020, I accessed an Electrum Bitcoin Wallet (the “Electrum Wallet”) of mine, which contained Bitcoin belonging to my wife and me, which was different to and separate from the digital assets in the 1Feex and 12ib7 Addresses. I did this to check that I had received a regular monthly payment in digital assets. Upon doing this, I observed that the expected payment had been received"

https://www.courtlistener.com/docket/6309656/963/5/kleiman-v-wright/

pg. 15 - paragraph 51

*Craig failed to list the account where these monthly payments in digital assets were received.

Craig also contradicts the argument about him not having any insight or access to his wifes finances. Affidavit of Ramona Ang (“Craig and I keep our finances

separate. As far as I am aware, Craig does not know the details of my financial affairs.”) But Craig's sworn statement said otherwise. He claimed to control a wallet holding Bitcoin belonging to both him and his wife. Plus there are records showing that Craig and Ramona held a joint account at Lloyds Bank.

https://caselaw.nationalarchives.gov.uk/ewhc/comm/2020/3242#start-of-document

5. More evidence about personally holding Bitcoin related accounts.

Craig's Witness Statement:

40. “I decided to sell all of the airdropped Bitcoin Core we had received on the Kraken exchange towards the end of August 2017. We did this for our personal holdings.”

59. “I actively sell bitcoin using multiple exchanges even to this day.”

( July 3, 2020 )

60. “I also have accounts with Kraken. SimpleFX, OKEX and FloatSV. All of these allow me to trade bitcoin if I so wish. I have used Kraken continuously in selling bitcoin to pay bills since I have been in the UK.”

http://www.courtlistener.com pg. 16-17

6. There is a requirement to list shares held in companies.

The law does not distinguish between direct and indirect ownership of shares. If a debtor has the ability to control the shares, whether through direct ownership or through a trust that they control, they are required to disclose them on Form 1.977.

Craig claims that the Tulip Trust is a Living Assignment trust that contains assets which he doesn't control, but that's not actually true. The trustee and beneficiary of the trust is his wife Ramona who is obviously not a independent or impartial party.

According to the lawsuit filed against me by his wife Ramona, Craig Wright R&D aka Craig Wright holds shares in W&K. Why wasn't it disclosed on Form 1.977?

Another company he has an interest in is Wright International Investments which holds shares in the UK version Wright International Investments UK Ltd.

Also Nchain and TAAL which he established with Calvin Ayre.

Strassen Limited is wholly owned by Dr Wright and his wife, Ms Ramona Ang.

https://bitcoindefense.org/wp-content/uploads/2023/04/security-for-costs-order-TTL.redacted.pdf

April 2019 - Craig's deposition testimony::

"At the end of the day, I own nothing. I do not own a single share in any company that I know of, I do not own a single disposition of a trust that I know of. I have no ownership of anything, which is what you are trying to get at."

*Three months before Craig gave this testimony, his company Wright International received 50,000 shares in Squire Mining.

Jan 21,2019 - Wright International is granted 50,000 shares in Calvins company Squire Mining. And this company is wholly owned by Craig.

https://webfiles.thecse.com/CSE-Form_11_-_October_7_2019.pdf

Options Granted Jan. 21, 2019

https://webfiles.thecse.com/CSE-Form_11_-_October_7_2019.pdf

7. Craig was required to include his drivers license number and Tax ID number. Initially he didn't comply. His attorneys may argue that he left it blank due to his Aspergers, but that excuse doesn't really hold up because he had a team of attorneys who could have easily reviewed the form before submitting it.

8. He was required to list his Home phone and Business phone, but he claims to no longer have phones or at least not ones in his name.

9. Craig was required to list his Home address and Business address. He initially failed to list either.

10. Craig was required to list any party that owes him money. but Instead of listing Calvin Ayre's TAAL company that contractually owes him $7 million dollars, he thought it was more entertaining to claim that I personally owe him $10 million dollars.

Below is an AUTHENTIC public business record (Form 10) that hopefully the Judge will not dismiss as hearsay or inauthentic. It was submitted by the President of the TAAL company to the Canadian Securities Commission.

On December 17, 2020, the Issuer entered into a loan agreement (the “Note”) with Wright International Investments Ltd. (the “Lender”),

The Lender is wholly-owned by Craig Wright, an advisor to the Company.

TAAL may repay the Lender at any time without penalty.

https://webfiles.thecse.com/CSE_Form_10_-_Notice_of_Proposed_Transaction_Dec_2020_Loan.pdf

https://sedar.com/ - Verifiably Authentic

(In the Search profile field type in TAAL)

(In the From date enter 18/12/2020)

(In the To date enter 18/12/2020)

click Search and a 65kb PDF file appears

In addition to Form 10 that was filed with the CSE, there were multiple press releases that support it's authenticity. One of the announcements was presented

directly on the TAAL corporate website.

They state that Wright International which is wholly owned by Craig loaned $7 million to Calvin Ayre's company TAAL (formerly known as Squire Mining)

TAAL CORPORATE WEBSITE

https://web.archive.org/web/20210119192952/https://www.taal.com/news/taal-announces-debt-financing/

https://www.prnewswire.com/news-releases/taal-announces-debt-financing-301196178.html

https://www.bloomberg.com/press-releases/2020-12-18/taal-announces-debt-financing-kiutzaev

11. During the trial, Craig adamantly testified that W&K IP existed as valuable software, and insisted that I had the rights to utilize and build upon it. But now in a Forbes article, he completely walks that testimony back and states that he personally controls the W&K IP because it exists only in his mind. Knowing Craig, he will also claim that none of this mind blowing IP found its way into the thousands of patents he filed through Nchain. This is a perfect example of the fraud that the Kleiman family has been dealing with for the past 10 years. Dr. Wright will change his story whenever it best suits him. During the trial, he deceived the judge and jury by suggesting that valuable software could be returned to the estate. However, now that the trial is over, he wants to completely retract that statement.

Catch Me If You Can

It is obvious that Craig has conspired with others to make himself appear immune to legal judgments.

The following are some of his online statements that mock the US justice

system and creditors:

6-29-????: “A US Court cannot force diddly”.

https://www.courtlistener.com/docket/6309656/1045/20/kleiman-v-wright/

5-30-2019: “I am Antiguan”.

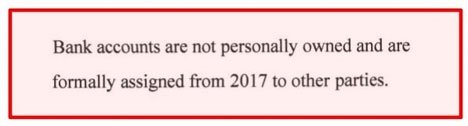

11-3-2021: “Have fun. There is nothing on this earth in my name from mid 2015 on, and even then little after 2011”.

1-10-2022: “In the fact of the matter is, I don’t own any BTC. […] assets are held in companies and trusts where I hold assets.”

2-27-2022: “I've made myself untouchable. If you bankrupt me, nothing happens. I keep leading and I keep building because nothing is in my name."

https://www.bitcoindefense.org pg. 33

7-26-2022: "If a person would spend 4 million to receive a dollar plus and 2 million costs... So the other side is bankrupt... What would you think?" "Ie. The only thing that matters is crushing the other side" "Well. I would spend 4 million to make an enemy pay 1.

8-26-2022: “Technically, I control none of the assets”.

8-26-2022: “[...] I was ordered to give a list of all coins I control. That is easy, nothing. I have very little in my name”.

Note: Craig never actually complied with the court order of providing an accurate list of his Bitcoin holdings. After turning over his list he later claimed that 2 very large bitcoin addresses were stolen from his personal computer. Those 2 addresses were NOT included on the list given to the court.

Craig's Statements about Complying with Court Orders were Vastly Different in 2019

Interview by Brendan Sullivan

https://www.courtlistener.com/docket/6309656/550/15/kleiman-v-wright/

Brendan:

But now you'll have to break the Tulip Trust

to transfer the coins.

Craig:

If the court makes an order, I will comply

with the order. And the court has made an order.

It's that simple

Craig:

Because they'll have to come out of partnership.

I spent more money on the project than Dave,

so I will rule on that and effectively Ira

will get maybe 480,000 BTC.

Craig:

Dave died, that was a worse day for me, because I lost a friend and a partner.

|